When providing insurance for your employees, many types could fit the business. Until recently, traditional, fully insured plans were the only option. Now, captives have hit the market hard. Let’s compare the costs associated with these models, helping you make an informed decision about which is best for your organization.

Traditional Insurance

Traditional insurance involves purchasing a policy from a commercial insurer. Companies pay premiums to the insurer, who in turn assumes the risk of covering claims. This model is straightforward and provides predictability, but it often comes with limited flexibility and higher overall costs. The insurer retains control over the premium pricing, policy terms, and claim payouts, which can result in less tailored coverage for the company’s specific needs.

Captive Insurance

Captive insurance, on the other hand, involves a company either creating its own insurance subsidiary or joining an existing group program to cover its risks. This captive insurer is owned and controlled by the policyholders, allowing for greater customization and potential cost savings. While setting up a stand alone captive can require significant initial investment and ongoing management the group programs we are referencing have already addressed the start up costs and already have the necessary management and oversight, it can offer long-term financial benefits and greater control over insurance expenditures.

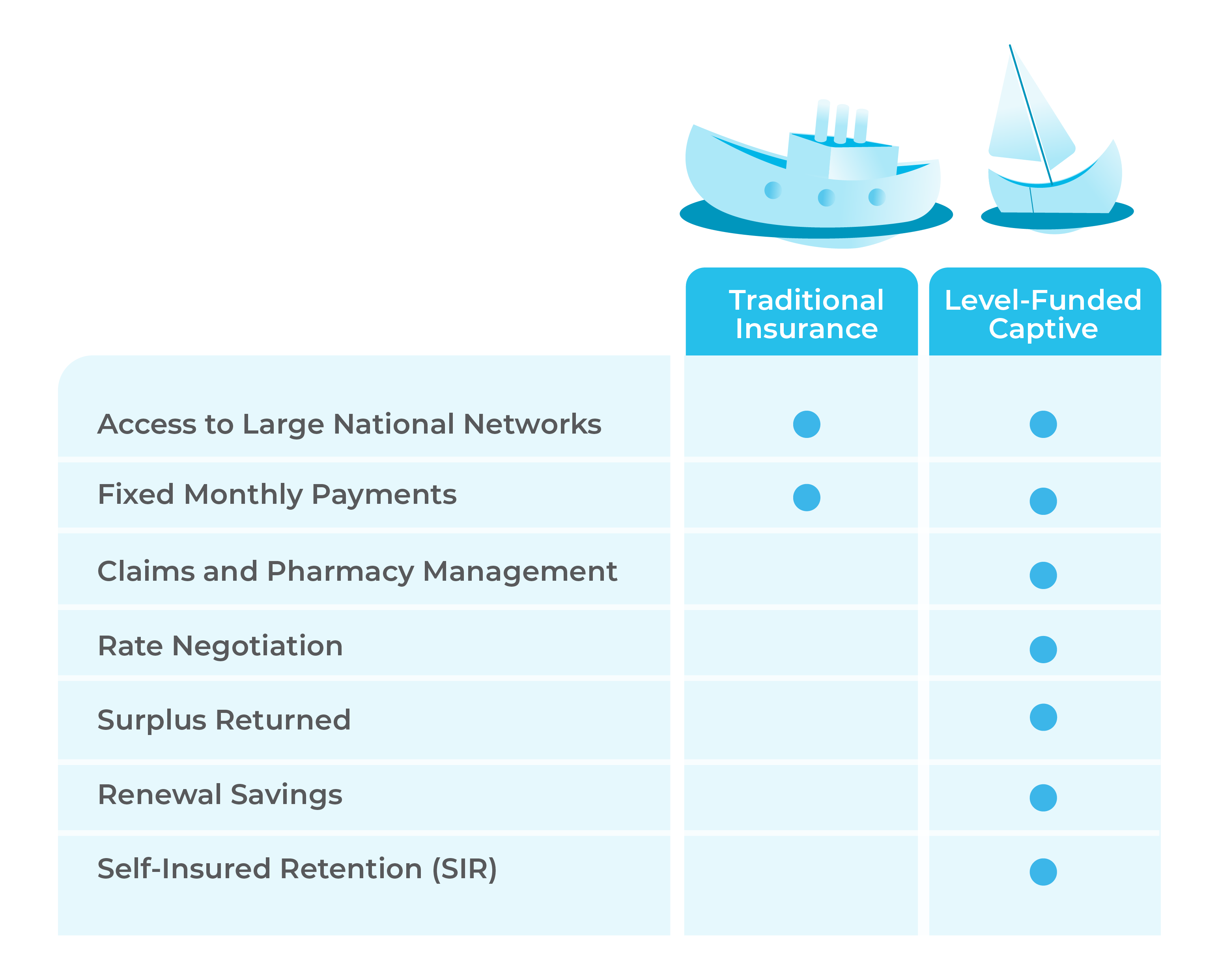

Key Differences: Captive vs. Traditional Insurance Cost Comparison

1. Premium Costs

-

Traditional Insurance: In traditional insurance, premiums are typically higher because they include the insurer’s profit margin, administrative costs, and the potential risk of underwriting losses. Premiums are set based on the collective risk pool, which may not accurately reflect the company’s specific risk profile.

-

Captive Insurance: Captive insurance allows companies to set premiums based on their own risk profile, potentially leading to lower costs. By eliminating the insurer’s profit margin and reducing administrative expenses, companies can often achieve more favorable pricing. However, the company must be prepared to assume more of the financial risk for claims.

2. Administrative Expenses

- Traditional Insurance: Administrative expenses are generally included in the premiums, and the insurer handles claims processing, compliance, and other administrative tasks. However, these costs can be substantial and are not always transparent to the policyholder.

-

Captive Insurance: In a captive arrangement, the parent company may need to handle some administrative tasks or outsource them, which can incur costs. However, these expenses can be managed and potentially reduced compared to traditional insurance. The company gains greater transparency and control over how these funds are allocated.

3. Risk Management and Claims Handling

-

Traditional Insurance: The insurer manages claims and assumes the risk. While this transfers risk away from the company, it also means less control over claims management and potentially higher overall costs due to the insurer’s profit motive.

-

Captive Insurance: Captives allow companies to directly manage claims, providing greater control over the process. This can lead to better claims management and cost containment strategies. However, it requires the company to have the necessary expertise and resources to handle these responsibilities.

4. Capital and Investment Income

- Traditional Insurance: The capital paid as premiums to a traditional insurer is not accessible to the company. Any investment income generated from these premiums benefits the insurer, not the policyholder. This structure provides little incentive for companies to invest in loss prevention and risk management.

-

Captive Insurance: In a captive arrangement, the parent company retains access to capital and can invest it. This investment income can offset some of the costs associated with running the captive and potentially lead to profits.

Considerations and Limits

While captive insurance offers several potential cost advantages, it is not without its challenges. Establishing a captive requires a significant upfront investment, regulatory compliance, and ongoing management. It also exposes the company to greater financial risk, as the captive must cover claims out of its own resources. However, the captive landscape is becoming more diverse, with expert-run solutions that address the needs and budgets of mid-size businesses.

On the other hand, traditional insurance provides simplicity, risk transfer, and predictability. It may be more suitable for smaller companies or those without the resources to manage a captive. However, the trade-off is often higher costs and less control.

Conclusion

Choosing between captive and traditional insurance requires a careful analysis of your company’s financial situation, risk tolerance, and long-term goals. Captive insurance can offer significant cost savings and control, but it requires a commitment to manage and mitigate risks effectively. Traditional insurance provides ease of use and risk transfer but at a potentially higher cost.

Ultimately, the decision will depend on your company’s unique circumstances. Consulting with insurance professionals, financial advisors, and legal experts can help you navigate this complex landscape and make the best choice for your organization’s needs. Whether you opt for a captive or traditional model, the goal remains the same: to provide quality coverage for your employees while managing costs effectively.

Whether you’re a business owner, HR professional, or financial executive, understanding captive health insurance can empower you to make informed decisions about your organization’s health benefits strategy. If you’re considering this option, contact our team of experts to navigate the complexities and unlock the full potential of captive health insurance for your company.

0 Comments