BUILT FOR EMPLOYER GROUPS

LEVREDGE

Transform your employee’s health with our Section 125 Group Fixed Hospital Indemnity Program. Bolstered by a strategic alliance with an A-rated carrier, we collaborate closely with you to tailor a solutions package perfectly suited to your business, achieving greater organizational savings.

BUILT FOR EMPLOYER GROUPS

LEVREDGE

Transform your employee’s health with our Section 125 Group Fixed Hospital Indemnity Program. Bolstered by a strategic alliance with an A-rated carrier, we collaborate closely with you to tailor a solutions package perfectly suited to your business, achieving greater organizational savings.

WHAT LEVREDGE DOES

HEALTH BENEFITS

Our LEVREDGE Program addresses overlooked gaps left by traditional major medical insurance plans. With a group-fixed hospital indemnity plan and an optional health screening rider underwritten by United States Fire Insurance Company, an Employee Assistance Program (EAP), 24/7 Telehealth services for both self and dependents, and evaluations of individual health risks and wellness levels, we guide participants towards healthier lifestyle choices and preventive care.

Connect individuals and families to coverage that meets a broad spectrum of healthcare needs.

SAVINGS FROM TOP TO BOTTOM

Our clients achieve pre-tax savings with our program, which features a Section 125 pre-tax deduction that reduces the taxable income of their workforce. Employees participating in at least one preventive healthcare activity per month may benefit from increased take-home pay, courtesy of post-tax claims for qualified activities.

WHAT LEVREDGE DOES

HEALTH BENEFITS

Our LEVREDGE Program addresses overlooked gaps left by traditional major medical insurance plans. With a group-fixed hospital indemnity plan and an optional health screening rider underwritten by United States Fire Insurance Company, an Employee Assistance Program (EAP), 24/7 Telehealth services for both self and dependents, and evaluations of individual health risks and wellness levels, we guide participants towards healthier lifestyle choices and preventive care.

Connect individuals and families to coverage that meets a broad spectrum of healthcare needs.

SAVINGS FROM TOP TO BOTTOM

Our clients achieve pre-tax savings with our program, which features a Section 125 pre-tax deduction that reduces the taxable income of their workforce. Employees participating in at least one preventive healthcare activity per month may benefit from increased take-home pay, courtesy of post-tax claims for qualified activities.

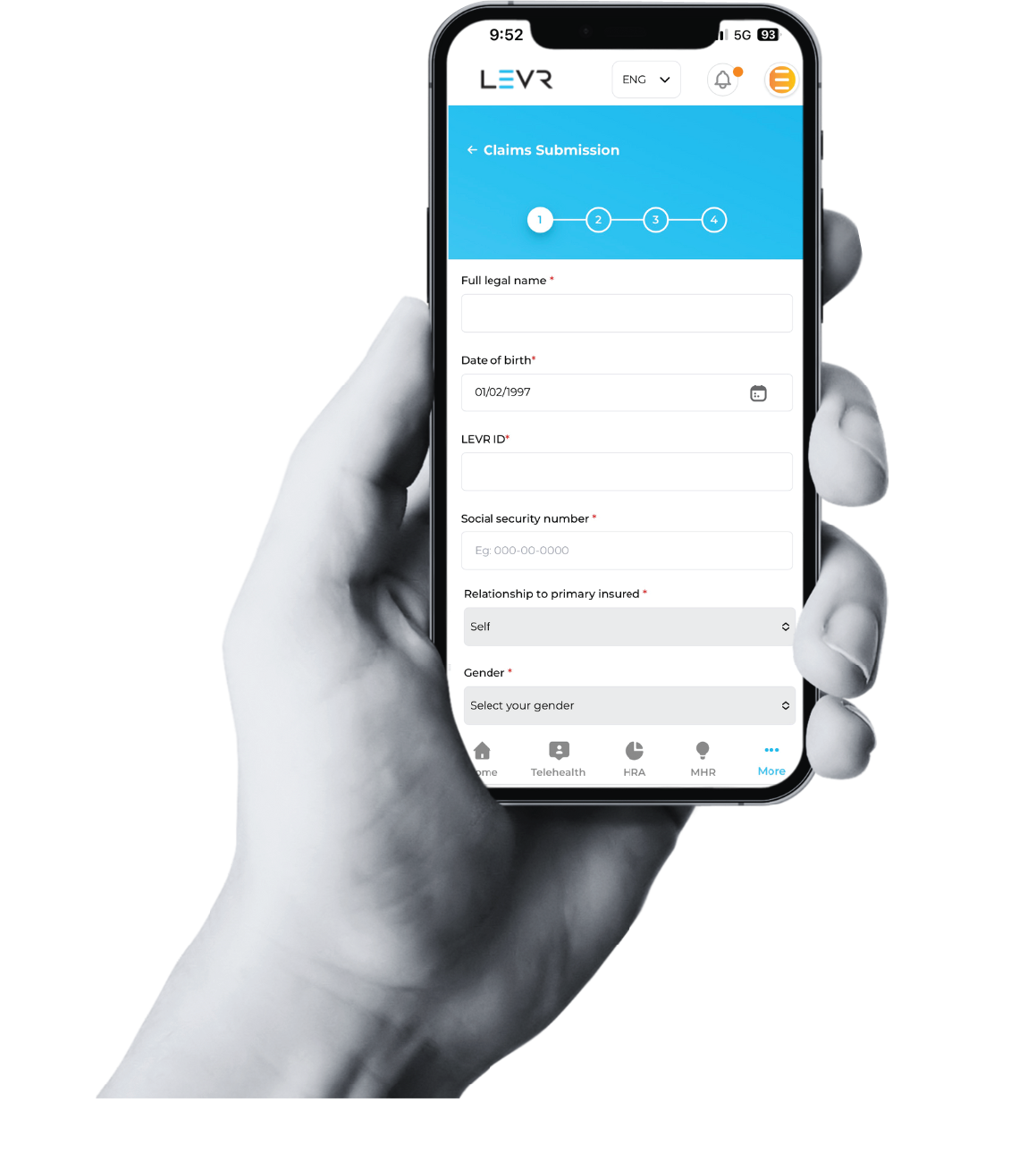

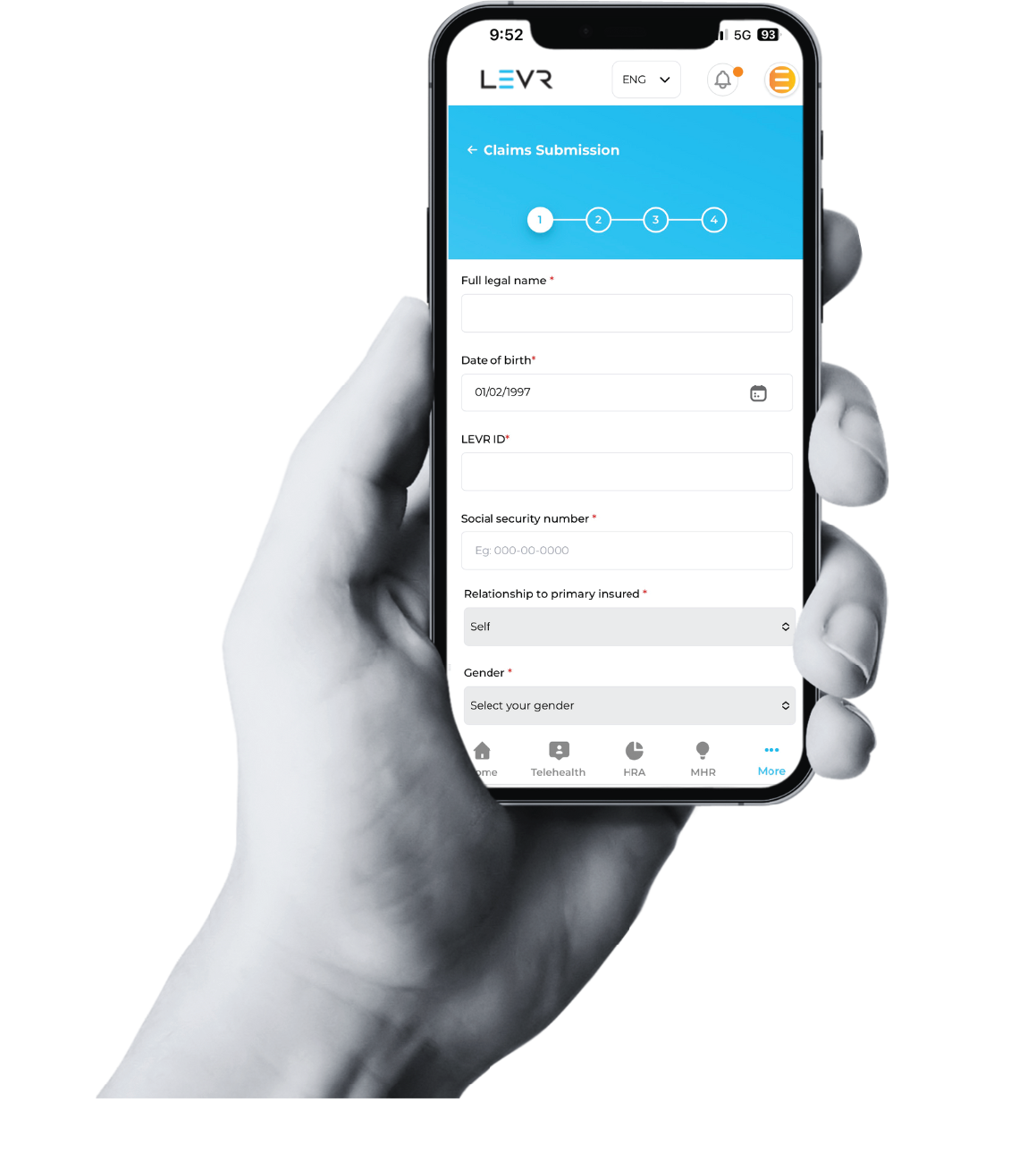

OUR PORTAL IN ACTION

ALL YOUR EMPLOYEE'S BENEFITS IN ONE SPOT

Members can access their benefits anytime, anywhere with our health portal using any smart device. Seamlessly connect with clinical professionals, submit claims, explore your personalized health library, and unlock other features—with a single, user-friendly login.

GROUP FIXED HOSPITAL INDEMNITY PLAN

CARE COMPENSATION

Our plan helps offer financial protection in the event of hospitalization. Our plan ensures coverage for hospital stays, ambulance services, emergency room visits, and other medical expenses. With our support, you can prioritize your recovery without worrying as much about financial burdens.

- Fixed compensation per covered medical event.

- Flexible coverage options to suit your individual needs and budget.

- Streamlined claims process with swift reimbursement.

GROUP FIXED HOSPITAL INDEMNITY PLAN

CARE COMPENSATION

Our plan helps offer financial protection in the event of hospitalization. Our plan ensures coverage for hospital stays, ambulance services, emergency room visits, and other medical expenses. With our support, you can prioritize your recovery without worrying as much about financial burdens.

- Fixed compensation per covered medical event.

- Flexible coverage options to suit your individual needs and budget.

- Streamlined claims process with swift reimbursement.

EMPLOYER HUB

STAY IN THE KNOW WITH OUR EMPLOYER DASHBOARD

Monitor your program analytics effortlessly with our real-time, intuitive dashboards. Gain instant access to crucial metrics and insights, empowering you to make well-informed decisions and maximize your benefits.

WE LOVE QUESTIONS

What is LEVREDGE?

LEVREDGE is a section 125 plan that offers a group hospital fixed indemnity insurance with emergency treatment and health screening indemnity rider. This benefit is aimed at improving your health by focusing on preventive medicine. LEVR Health’s insurance carrier pays or reimburses you for your claim benefits according to the terms and conditions of the policy. You can use those claim benefit amounts to pay for your qualified, out-of-pocket medical expenses.

Is LEVREDGE health insurance?

No. The LEVREDGE Program is a supplemental plan that is separate from your current medical coverage or other coverage your business may offer. The LEVREDGE Program does not affect your current major medical health plan coverage. To look into possible savings for your major medical insurance, please see our medical captives offering.

How is the LEVREDGE Program’s claim payment paid to an employee?

The benefits payable by LEVREDGE’s hospital indemnity insurance policy will generally be paid by check to the employee. However, the Health Screening Benefit is paid to the employee through the employer’s payroll system, via a deposit made directly into the employee’s paycheck.

GET STARTED

LET'S BUILD BETTER EMPLOYEE BENEFITS TOGETHER

GET STARTED

LET'S BUILD BETTER EMPLOYEE BENEFITS TOGETHER

THIS IS A LIMITED BENEFIT POLICY. The insurance described in this document provides limited benefits. Limited benefits plans are insurance products with reduced benefits intended to supplement comprehensive health insurance plans. This insurance is not an alternative to comprehensive coverage. It does not provide major medical or comprehensive medical coverage and is not designed to replace major medical insurance. Further, this insurance is not minimum essential benefits as set forth under the Patient Protection and Affordable Care Act.

This is a brief description of coverage provided under group policy form numbers, HIP-30000P and HIP-30000R-HSI, and is subject to the terms, conditions, limitations and exclusions of the policy. Please see the policy and certificate for complete details. Coverage may vary or may not be available in all states.

Insurance benefits are underwritten by United States Fire Insurance Company. C&F and Crum & Forster are registered trademarks United States Fire Insurance Company. The Crum & Forster group of companies is rated A (Excellent) by AM Best Company 2023.