A self-insurance model by which a firm forms its own insurance entity, captive insurance has become a more popular risk management and cost-control strategy for businesses. Both group captives and single-parent captives are two typical structures that fall into this model. Although they operate with the same end purpose of offering customized risk-management schemes, the main variations exist in the ownership, structure, and risk-sharing strategy.

Below, we break down the differences between group captives and single-parent captives so you can decide what model would be the best fit for your organization.

What is a Captive Insurance Company?

Before diving into the comparison, it’s important to understand the basics of a captive insurance company. A captive is an insurance company formed by one or more businesses to insure their own risks. With this, the intention is to avoid utilizing the conventional insurance marketplace, so that savings will be achieved, profits will be kept, and more control over their insurance programs will be attained. Captives help customize coverage for the individual risk profile of a company.

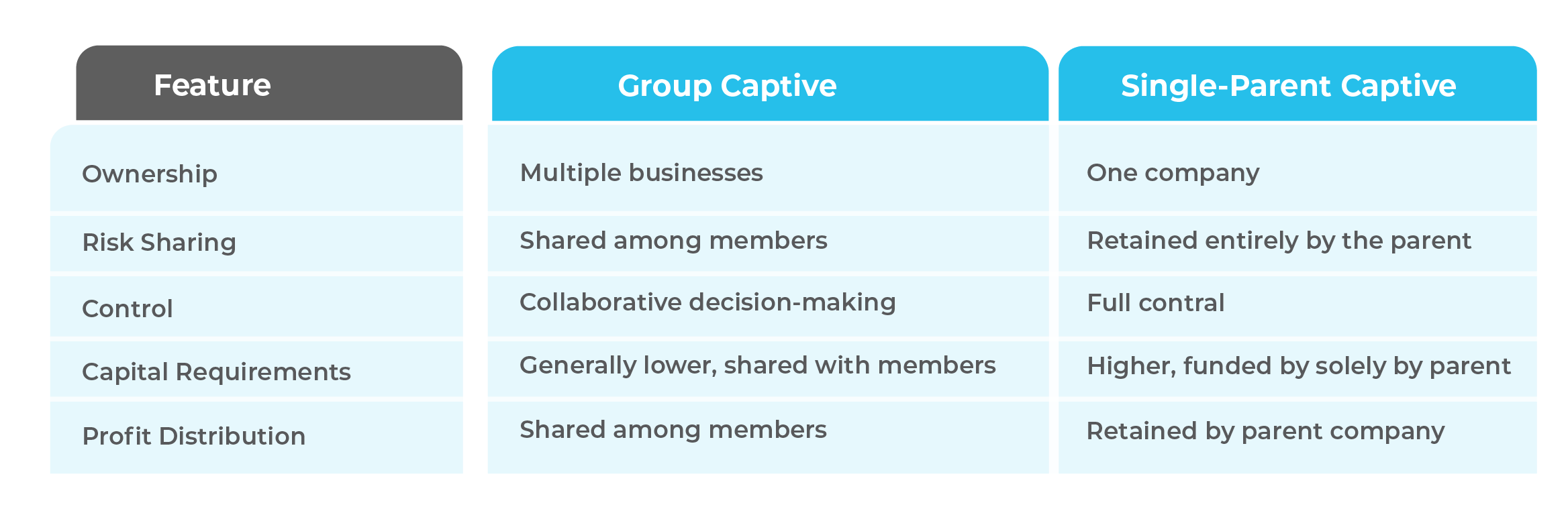

At a Glance: Key Differences Between Group

and Single-Parent Captives

Here’s a quick comparison between the two.

What is a Group Captive?

A group captive is a captive insurance carrier owned and controlled by two or more unrelated businesses. All the companies put their risks together and equally share the profits and losses of the captive. Group captives are frequently created by companies in the same industry or with similar risk profiles so that the members can take advantage of shared risk-pooling and, hopefully, lower insurance premiums.

If your workforce tends to be lower-risk than the average in the open insurance marketplace, being part of a group captive can translate into substantially lower premiums. In the typical insurance marketplace, premiums are dictated by the average risk in a large pool of employers who share disparate exposures to injury, disease, and claims. By being part of a group captive with similar-minded, safety-oriented companies, your organization enjoy premiums that more accurately reflect your own level of risk.

For instance, an office-based accounting firm will have much lower exposure to physical dangers than a coal mining company, in which risk is much greater. In the case of a group insurance pool, the two businesses could be placed together, placing a higher premium on the lower-risk employer. More precise pricing can be achieved through a group captive composed of similar low-risk employers, such as professional services businesses.

Key Features of Group Captives:

-

Shared Ownership: Ownership is distributed among the participating companies.

-

Risk Sharing: Risks and losses are shared, which mitigates the financial impact of large claims for any single member.

-

Economies of Scale: Larger risk pools can result in better reinsurance terms and reduced administrative costs.

-

Entry Requirements: Members typically must meet financial and operational criteria, ensuring stability and like-minded commitment to risk management.

-

Collaborative Control: Decisions on coverage, governance, and operations are made jointly by the members.

Benefits of Group Captives:

-

Cost Savings: Members often pay lower premiums than they would in the traditional insurance market.

-

Risk Diversification: Risk is spread across the member base.

-

Profit Sharing: Underwriting profits and investment income are distributed among members.

-

Customized Coverage: Captive programs can be tailored to the specific risks faced by the group’s industry or operations.

Who Should Consider a Group Captive?

Group captives are generally for small to medium-size companies that don’t have the capital to create a captive but would still prefer the advantages of self-insuring. Manufacturing, construction, logistics, and transportation sectors are examples of industries that create group captives so they can take advantage of the shared risk exposures and benefit from power in numbers.

What is a Single-Parent Captive?

A single-parent captive (also known as a pure captive) is an insurance company owned and controlled in whole by another firm, often a big business. It is formed to insure only the risks of its parent company or its affiliates. Unlike group captives, single-parent captives do not involve risk-sharing with unrelated entities.

Key Features of Single-Parent Captives:

-

Sole Ownership: The parent company is the exclusive owner and decision-maker.

-

Full Risk Retention: All risk is borne by the parent company.

-

High Customization: Coverage can be precisely designed for the company’s unique exposures.

Benefits of Single Parent Captives:

-

Complete Control: The parent company has total authority over the captive’s structure, policies, and operations.

-

Profit Retention: Any surplus the captive generates is retained entirely by the parent company.

-

Tailored Risk Management: Coverage can be precisely tailored to the company’s specific needs, offering more comprehensive risk protection than what might be available in the traditional market.

-

Potential Tax Benefits: Single-parent captives may offer tax advantages, as premiums paid to the captive can sometimes be tax-deductible (subject to regulatory requirements).

Who Should Consider a Single Parent Captive?

Single-parent captives are generally a better fit for large companies with substantial financial resources and a high volume of insurable risk. Industries such as healthcare, energy, and multinational corporations often form single-parent captives to gain full control over their insurance needs, reduce costs, and enhance risk management strategies.

CONCLUSION

Group captives and single-parent captives provide viable alternatives to standard insurance, allowing businesses more control over the management of risk and the possibility for cost containment. Which one you choose will depend on the size, risk profile, and budget of your organization.

Group captives might be more suitable for companies wanting the advantages of self-insurance but not the responsibility of doing it on their own.

Single-parent captives provide unparalleled control and customization for companies with the resources to fund them independently. Understanding the nuances of each model is critical for choosing the right captive insurance strategy for your business.

Whether you’re a business owner, HR professional, or financial executive, understanding captive health insurance can empower you to make informed decisions about your organization’s health benefits strategy. If you’re considering this option, contact our team of experts to navigate the complexities and unlock the full potential of captive health insurance for your company.

0 Comments